The Importance of Getting Your Finances in Order Before You Pass Away: A Guide for Peace of Mind and Family Stability

Discovering the North Andover Historical Society Museum: A Journey Through Time

September 3, 2024Why Organizing Your Finances Before You Pass is Crucial for Peace of Mind and Family Stability

No one likes to think about death, yet it is an inevitable part of life. While the emotional toll of losing a loved one can be overwhelming, the financial aftermath can sometimes exacerbate the stress for family members left behind. One of the most thoughtful, responsible actions you can take is to get your finances in order before you pass away. Doing so will ensure that your family doesn’t have to navigate complex financial decisions while grieving.

In this article, we will discuss the importance of financial preparation before death, including organizing legal documents, estate planning, setting up insurance, and outlining final wishes. Proper planning can ease the burden on loved ones, avoid unnecessary legal complications, and help ensure that your assets are distributed according to your wishes.

Why Financial Planning Before Death Matters

Getting your finances in order before you pass away can relieve your family of significant emotional and financial strain. When there is a lack of preparation, families often face confusing or chaotic situations—disagreements can arise, assets may be difficult to access, and debts may go unpaid.

Some of the critical reasons for pre-death financial planning include:

- Clarity for Loved Ones: Family members already grappling with grief should not have to decipher your financial situation or make tough decisions without guidance.

- Avoiding Legal Disputes: Proper planning helps avoid disputes among family members regarding your assets or final wishes.

- Minimizing Taxes and Legal Fees: Estate planning helps reduce taxes and legal costs associated with transferring assets.

- Ensuring Your Wishes Are Followed: Clear documentation ensures that your assets are distributed as you intended.

- Avoiding Debt Burden on Family: Financial planning prevents your family from taking on unpaid debts that they may not have been prepared to cover.

Key Steps to Getting Your Finances in Order

1. Organize Important Financial Documents

One of the first and most important steps is gathering and organizing all your financial documents. These should be easily accessible for your executor or family members. Key documents to gather include:

- Bank statements: Provide a clear picture of all your accounts, including checking, savings, and money market accounts.

- Investment accounts: Include details on stocks, bonds, mutual funds, retirement accounts, and any other investments.

- Insurance policies: Life, health, home, and auto insurance policies should be clearly documented.

- Mortgage or loan information: Ensure all information regarding outstanding debts and mortgages is available.

- Tax returns: Keeping several years’ worth of tax returns provides clarity on your financial history.

- Will and testament: Ensure that you have a legally binding will that outlines your final wishes.

- Funeral prepayment plans: If you have prepaid for funeral expenses, include the paperwork.

Organizing these documents will help the executor of your estate, your family, or any professional advisors manage your affairs efficiently.

2. Create a Will or Living Trust

Creating a will is one of the most important steps in ensuring your assets are distributed according to your wishes. Without a will, your estate may go through a lengthy probate process, and the distribution of your assets could be left in the hands of the court. A will should include:

- Beneficiaries: Designate individuals who will inherit specific assets.

- Executor: Appoint a trusted person to carry out the terms of your will.

- Guardianship: If you have minor children, clearly name a guardian for them.

- Charitable Contributions: If you plan to leave money or assets to a charity, include specific instructions.

A living trust is another option that helps avoid probate by placing your assets into a trust during your lifetime. Upon your death, the assets can be transferred directly to your beneficiaries without the delays of probate.

3. Review and Update Beneficiaries on Financial Accounts

Make sure the beneficiaries on your retirement accounts, life insurance policies, and other investment accounts are up-to-date. This is an often-overlooked step, but it is crucial. If your beneficiary designations are outdated—such as still listing an ex-spouse—it could cause unnecessary complications or disputes. Regularly reviewing and updating beneficiaries ensures that your assets will go to the intended individuals.

4. Plan for Final Expenses

Funeral costs, medical bills, and legal fees can quickly add up. Planning for these expenses in advance can ease the financial burden on your family. Some of the key considerations include:

- Life Insurance: Ensure you have adequate life insurance coverage to provide for your family and cover final expenses.

- Funeral Preplanning: Some people choose to prepay for their funeral services, ensuring that their loved ones are not financially burdened.

- Emergency Savings: Set aside funds specifically for unexpected expenses that might arise upon your passing.

By preparing for these costs, you can minimize financial strain on your loved ones during an already challenging time.

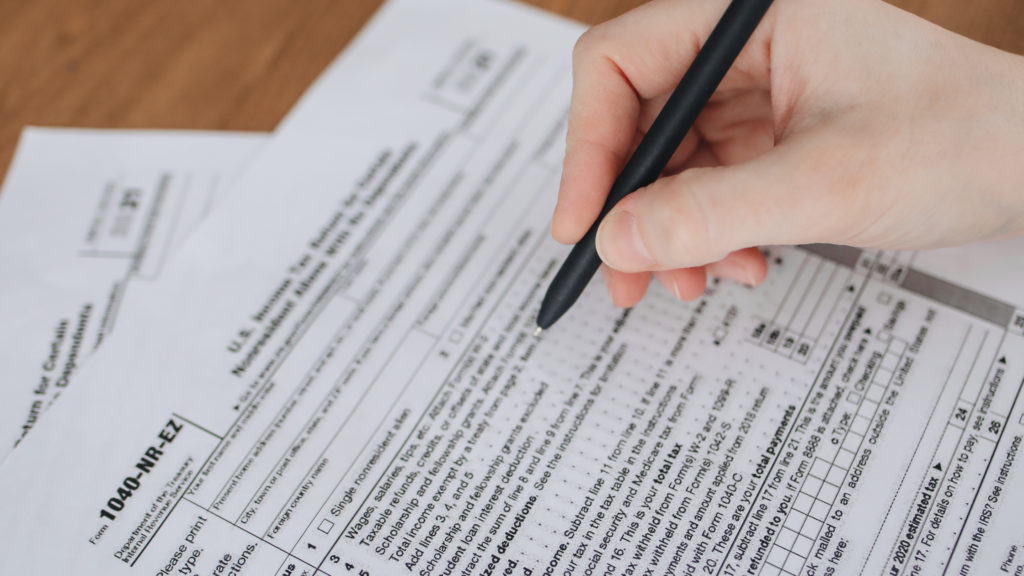

5. Consider Tax Implications

Understanding the tax implications of your estate can save your heirs significant amounts of money. Estate taxes can apply depending on the size of your estate and the jurisdiction in which you live. By working with a financial advisor or estate attorney, you can employ strategies to reduce or eliminate the tax burden on your heirs. Some strategies include:

- Gifting: Give gifts to family members before your death, reducing the size of your taxable estate.

- Charitable donations: By leaving part of your estate to charity, you can reduce your estate taxes.

- Trusts: Establishing a trust may help in minimizing taxes while ensuring your assets are passed on smoothly.

- Prepare for Medical and Long-Term Care Costs

As you age, it’s important to plan for potential medical expenses, including long-term care, which can be costly. While Medicare may cover some medical costs, it generally doesn’t cover long-term care, such as nursing homes or assisted living facilities. Consider the following options:

- Long-term care insurance: Purchasing a long-term care insurance policy can help cover the costs of a nursing home, assisted living, or in-home care.

- Health care directives: Ensure you have a health care power of attorney or living will in place, outlining your preferences for medical treatment if you become unable to make decisions for yourself.

- Set aside savings: Some individuals opt to set aside specific funds to cover medical and long-term care costs.

By addressing these concerns in advance, you can avoid putting your family in a difficult position of making health care decisions without knowing your wishes.

6. Set Up Durable Powers of Attorney

A durable power of attorney is a document that allows you to appoint someone to manage your finances or make health care decisions if you become incapacitated. Without a durable power of attorney, your family may have to go through a lengthy and expensive court process to gain control over your affairs.

- Financial power of attorney: This gives someone the authority to handle your financial matters, such as paying bills, managing investments, and dealing with taxes.

- Health care power of attorney: This gives someone the authority to make medical decisions on your behalf if you are unable to do so.

Choosing a trusted family member or friend to act as your power of attorney can help prevent confusion and ensure that your affairs are handled as you would wish.

The Emotional and Financial Relief for Your Family

Taking the time to organize your finances and plan for the future will provide immeasurable emotional and financial relief to your family. The death of a loved one is one of life’s most difficult challenges, and having to sort through a messy financial situation can add unnecessary stress to an already difficult time.

- Reduced Family Conflict: When your wishes are clearly outlined, it can reduce conflict among family members over the distribution of assets or decisions regarding your care.

- Easier Access to Funds: With proper financial planning, your family can access funds for immediate expenses, such as funeral costs, without delays.

- Avoiding Debt Burden: Proper planning can ensure that outstanding debts are paid from your estate, preventing your family from inheriting financial burdens they are not prepared to handle.

Final Thoughts: Financial Planning as a Gift to Your Family

Getting your finances in order before you pass away is not only an act of financial responsibility, but also a compassionate step to protect your loved ones from unnecessary stress and confusion. However, navigating the complexities of estate planning, wills, trusts, and other financial matters can be overwhelming. This is where seeking expert legal guidance becomes invaluable.

If you’re unsure where to begin or need assistance with drafting a will, setting up trusts, or organizing your estate, consider reaching out to a qualified estate planning attorney. Adam Tobin Law specializes in estate planning and can help you create a clear, legally sound plan that ensures your financial affairs are in order. With their experience in wills, trusts, and probate law, they can provide the guidance and support you need to protect your assets and ease the burden on your family.

For personalized legal assistance, visit Adam Tobin Law’s contact page to schedule a consultation. Preparing now will give you peace of mind, knowing that your loved ones will be taken care of and your wishes will be respected.