Three Reasons Why You Need an Elder Law Attorney Now

August 13, 2020National Estate Planning Awareness Week

October 6, 2020As the nation faces the sixth month of the coronavirus epdemic, we hope you and your loved ones are healthy and following all public health advisories to stay that way.

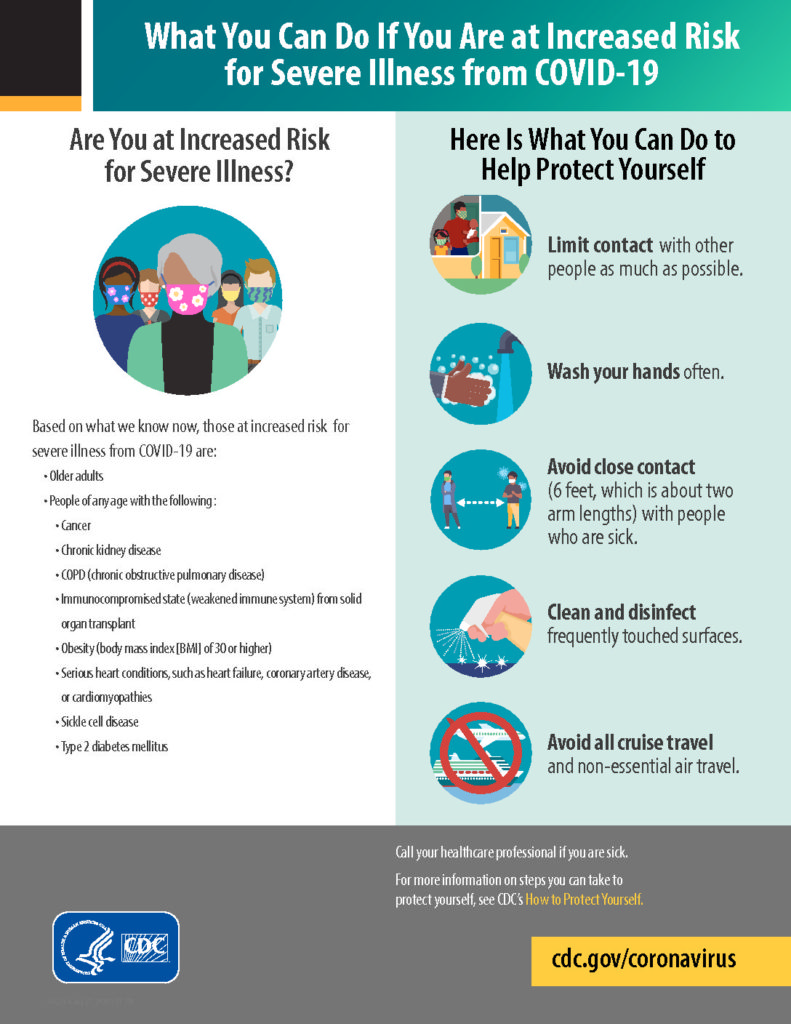

At the same time, we share in the knowledge that older Americans are at greater risk of severe illness from COVID-19. According to the CDC, severe illness means that a person diagnosed with COVID-19 may need hospitalization, intensive care, or a ventilator, or they may even die.

That’s why we put together this coronavirus estate planning checklist with these three key steps:

Assess your personal finances. Do you have the funds to cover health care and household expenses in case of illness? Do you have auto-pay systems in place to keep bills paid on time? Is it time to consider setting up things like a joint checking account that an adult child could use on your behalf?

Review your beneficiary designations. Are names and addresses accurate?

Update or begin your estate plan. Even if a global pandemic wasn’t happening, it’s still a good idea to review an existing estate plan to make sure all elements are up to date. If you’ve put off an estate plan, there’s no better time to develop one.

The CDC provides guidelines for how older Americans can reduce the risk of contracting COVID-19. Recommended precautions include limiting interactions with others as much as possible, wearing a mask, washing your hands often, and putting at least six feet of distance between yourself and people who don’t live in your household.

Since May 6, Massachusetts is under an executive order from the governor that requires people to wear face masks in public places, both indoors and outdoors, where social distancing is not possible. It’s become commonplace to wear masks while shopping and running errands. When you wear a cloth mask, it should:

- cover the nose and mouth

- fit snugly on the face

- secure with ties or ear loops

- include multiple layers of fabric

- allow for breathing without restriction

- be machine washable and dryer safe

You can buy masks online and at many local stores and pharmacies.

As of September 4, Massachusetts recorded 121,046 confirmed cases on COVID-19. Total deaths among confirmed cases was 8,925.

According to the CDC, 8 out of 10 COVID-19 deaths in the United States have been in adults 65 years or older. This sobering statistic underscores the need for older Americans to have an estate plan in place. An experienced Massachusetts elder law attorney like the Law Offices of Adam J. Tobin can assist you with all aspects of your estate plan.

Do you already have an estate plan in place? At this unprecedented time, it’s important to review all documents to make sure they are up to date and follow best practices.

Reviewing an estate plan can also ensure that names and addresses of beneficiaries are accurate and current.

Just as a reminder, here’s what an estate plan should include:

- A living trust. You can create a revocable or irrevocable living trust to protect assets and make sure that they transfer smoothly to the trustee after death. Living trusts can be created to avoid probate or inheritance tax.

- A will. A will designates possessions after your death. This might include property not in a trust, jewelry, personal items, bank accounts, and other financial assets.

- A power of attorney. A durable power of attorney gives an individual power to oversee your personal and financial decisions in the event that you cannot. This is often used in cases of advanced age and illness, and as a safety precaution to protect you in the event of an accident.

- A health care proxy. A health care proxy can make all of the health care decisions for a person who is not capable of answering for their care.